Tax filers, your Middle Class Tax Refund is safe from Uncle Sam.

Two weeks after California began sending income-reporting 1099 forms to recipients, the IRS on Friday said it would not tax the inflation relief payment.

“In the interest of sound tax administration and other factors, taxpayers in many states will not need to report these payments on their 2022 tax returns,” the IRS said in a statement.

READ MORE: Here’s another way to check your MCTR status

California was among 18 states that issued some type of refund to taxpayers in 2022. For those who received an MCTR of $600 or more, a 1099-MISC was issued by the Franchise Tax Board.

That form and its tax implications set off a whirlwind of questions about whether or not the federal government would claim a big bite of disaster relief payments, which amount to $9 billion in California.

The IRS said that after a review, it determined it “would not challenge the taxability of payments related to general welfare and disaster relief.”

RELATED: Can I get paper check instead of debit card?

The other states with relief payments that were exempted from taxation include Colorado, Connecticut, Delaware, Florida, Hawaii, Idaho, Illinois, Indiana, Maine, New Jersey, New Mexico, New York, Oregon, Pennsylvania and Rhode Island. Alaska is in this group as well, but please see below for more nuanced information.

What is the MCTR?

The inflation refunds were approved by state in summer 2022 to help offset rising inflation.

Payments range from $200 to $1,050 and go to taxpayers only. Single filers with no dependents who earn less than $250,000 annually will get $350. Joint filers get $700. Add qualifying dependents and the refund jumps by $350. Those who earn more than $250,000 but less than $500,000 are getting the lowest refunds.

Social Security and welfare recipients who do not file taxes were not eligible for the MCTR.

The IRS on Friday offered a rare thank you to taxpayers, tax professionals, software companies and state tax administrators for their patience as the IRS and U.S. Treasury Department “worked to resolve this unique and complex situation.”

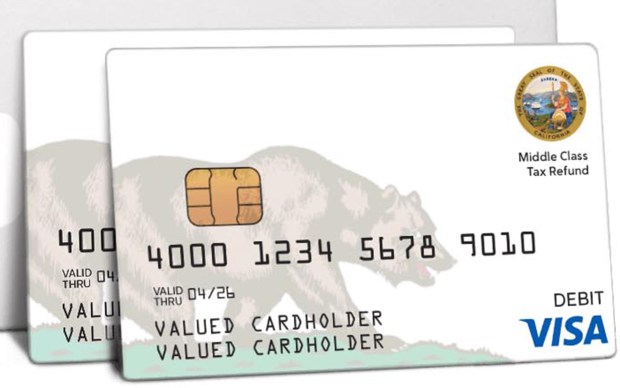

California reported Jan. 13 that it had approved $9 billion worth of payments for 16.6 million recipients. Money Network, which won a $25 million contract with California, is in charge of distributing debit cards to recipients. Direct deposit MCTR payments, issued to electronic tax filers who got a refund in 2021, were handled by the FTB.

The tax board said it will offer a new update Feb. 22 on the MCTR distribution.

For those still wondering where their MCTR is, we’ve got a new tip from Marc, a reader who managed to reach a human at the FTB.

“I got into FTB through the line for legislator’s representatives (kind of sneaky), and she gave me specific directions. I had missed one step because it wasn’t originally given to me,” Marc wrote.

Here’s his tip:

1. Call 800-542-9332

2. Press 1 for English

3. Listen to the entire recording and press 1 for “other”

4. Listen to the entire recording and press 9

5. Listen to the entire recording and press 2

6. The system asks why you are calling. Say “speak to a representative”

7. It then puts you into a queue to wait for a person (Marc says that took 30 minutes, so it’s best to do this in the morning).

“I got a person who verified I should have gotten a card, and she agreed to send me a check,” Marc wrote.

The FTB expects MCTR refunds to continue into February as it clears holds placed on certain accounts.

One last tip: Check your bank accounts. Nina, an Orange resident, wondered where her payment might be. After checking her accounts, she saw a $700 deposit quietly landed in her bank account — in November.

Keep me posted on your progress. Email me at sgowen@scng.com